EBE Mobile Banking Powered by eBSEG is Now Live on Google Play and Apple App Store.

EBE Mobile Banking Powered by eBSEG is now Live on stores adopting a unique Experience to the latest digital banking customer expectations.

The Current evolution of customer behavior, generating the era of aggressive competition to drive banks to reshape their traditional customer engagement and business models.

By transforming their business models to digital, with a mission of extraordinary user experience through powerful and innovative next-generation digital banking platforms, Banks are facing challenges to avail their services through the Multitude of Digital Channels especially Mobile Banking in a consistent and powerful manner.

To overcome those challenges, EBE Bank ventured with eBSEG a partnership journey to help bank customers manage their business via Mobile Banking Application.

EBE Mobile Banking gives you access to your accounts wherever and whenever you need it, with a wide range of transactions inquiry.

We executed the first phase for Mobile Banking Application for EBE which include:

-

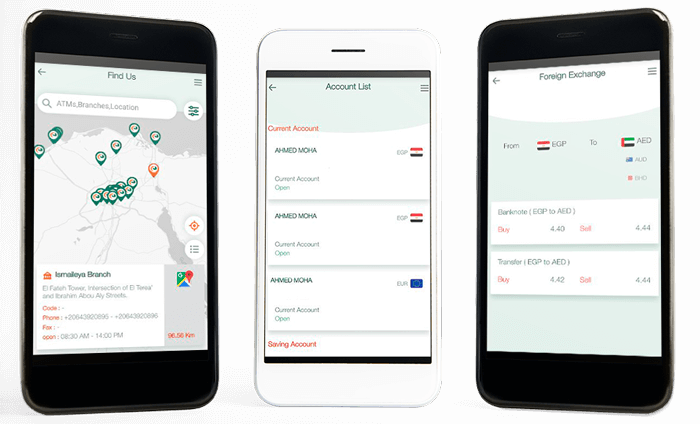

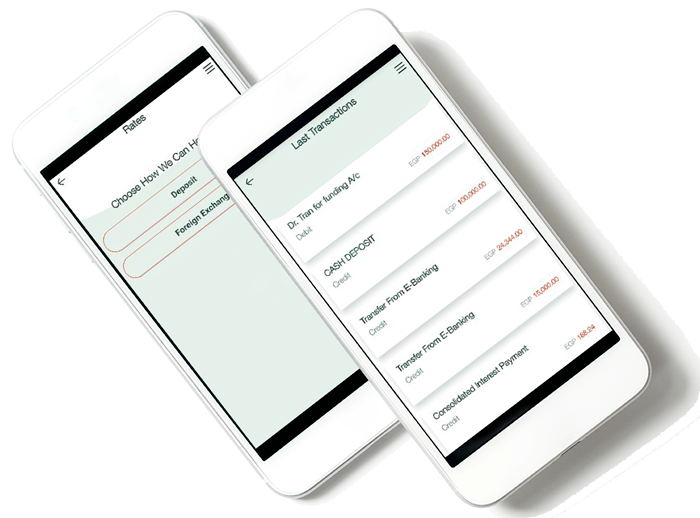

Access to your accounts wherever and whenever you need it, with a wide range of transactions query.

Get quick, easy, secure access to your EBE current, saving accounts, T/D’s, CD’s, Check and Loans.

Currency Exchange.

-

Find Us with Google map for branch locations and ATMs.

Cheques Inquiry (issued/Collection).

Security Awareness Instructions.

About eBSEG Digital Banking Solution

eBSEG Digital Banking Solution offers a secure and rich UX application providing a world class banking and payment experience to your customers over mobile Banking and internet banking.

eBSEG Digital banking solution offers a comprehensive suite of the latest banking services empowering banks to successfully deliver "any time" , "any where" banking services to customers on the GO.

in 2022, eBSEG has two awards from World Business Outlook and The Global Economics as The Best Digital Banking Omnichannel Solution Provider.

Also, the eBSEG Digital Banking Solution is available on the following Channels:

1- Internet Banking (Desktop).

2- Mobile Banking.

3- Tablet Banking.

4- Chat Bot Banking (Text & Voice).

5- Digital Bank Marketing.

6- Apple Watch Banking.

7- Business Banking Omnichannel.

8- ATM / Kiosk Banking.

9- Call Center Banking.

10- eBranch Banking.

11- Messaging Banking.

About CEEP™ Customer Experience Omnichannel Platform:

CEEP is a Patent granted by USPTO based Customer Experience and Engagement Platform that can provide one single Unified Omni-Channel Solution based on one single source code that addresses all your channels including Web, Mobile, Tablet, Chatbot, ATM, Kiosk, Apple Watch and Messaging.

eBSEG CEEP™ Platform gives the answer to the main question which a lot of organizations have on how to unify their channels into a single Omnichannel Solution and provide their customers the ubiquitous digital experiences, true build once deploys many architectures, across multiple devices and customer touchpoints.

CEEP™ is all about “Lean Portal” output and is built using “widget-based architecture”. to deliver a strategic technological vision capable and flexible to meet the some of the top customer requirements such as:

-

1- On-the-Go one time, future or recurring bill payments made easy.

-

2- Easy & secure Bank Transfer on-the-go between accounts or by email.

-

3- Comprehensive Bank Inquiries at Customers fingertips! Full information of bank accounts, Credit Cards, Loans, or payments Access a variety of bank account options & transactional history.

4- High Security Encryption communication layer that makes it impossible to hack, keeping customers secure, EVERYtime.

5- Quickly designate and update beneficiary information, avoid legal disputes, and safeguard confidential information. Store + print the new changes with ease.

6- Manage all of your credit cards aspects smartly, conveniently and securely, Anytime, Anywhere with eBank, 24/7. Check balances, credit, transaction history & pay credit card bills.

7- Best indicator of where you want to go, use Transaction History from any where.

8- GPS integrated Locator for immediate access to ATM or branch office.

9- And much more.

About EBE

EBE (Export Development Bank of Egypt) was established in 1983 for the purpose of boosting Egyptian exports and supporting establishments of agricultural, industrial, commercial and services sectors. Soon after, the Bank became the main funding source of exports operations in Egypt. The Bank plays a vital role in supporting Egyptian exporters and facilitating the access of Egyptian products to markets worldwide through the extension of finance of export, and import substitution projects to help improving the local production. This goes along with its significant role in participating in syndicated loans and equity participations of these projects. The Bank extends its full-fledged financing and Banking services to exporters and its entire customer base.

Check the following links to download the mobile banking application:-